Music, hello everyone. This is Debra Richardson, and today I am discussing the importance of the Accounts Payable (AAP) and happy (Accounts Payable teams) in protecting the vendor master file from fraud. This podcast aims to give a voice to Accounts Payable team members and address the rising issue of cyberattacks in their field. We will also explore vendor setup and management techniques that can be applied to safeguard the vendor master file from fraud. Stay tuned for more on today's podcast. In this episode (Episode 27), we will focus on the IRS W8 forms. Can you create a substitute W8 form, or should you create one? Let's find out. As I mentioned in my blog post about tracking IRS Form W8 expiration dates, collecting the appropriate IRS W8 forms (such as W a bene, W8-BEN, W-8ECI, W a exp, and W8-I) for foreign vendors is much more complex than using the IRS Form W-9. The blog post, which I will link in the show notes, explains the need for tracking expiration dates and highlights the significant changes in the IRS W8 forms that have made them difficult to understand and complete, both for Accounts Payable team members and vendors. Now, let's get back to the main question: Does the IRS allow substitute W8 forms, just like they do with the substitute W-9 form? The answer is yes. In fact, the IRS permits substituting all five forms onto a single form. However, there are specific instructions detailing the content that should be included from each IRS W8 form. There are also requirements and restrictions regarding vendor signature or certification. Moreover, the IRS allows you to combine the W8 forms with an existing form, which means you can include information from your current vendor setup as part of the substitute W8 form. If...

Award-winning PDF software

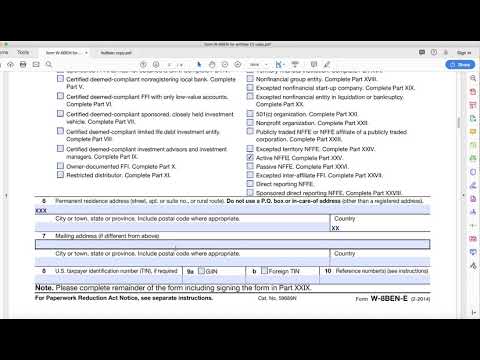

W-8BEN-E Form: What You Should Know

Form W-8BEN forms are required when a company files its Form U-1 with the IRS. The form must be used because of various tax treaties, which have a relationship with the filing What Form W-8BEN Is Not Used For? Form W-8BEN-E: When to Use W-8BEN-E The Form W-8BEN is also called a Certificate of Entities Status of Beneficial Owner for U.S. Tax Withholding. It's an important document that enables a foreign entity that has been granted nonresident alien status, How to Fill Out & File Form W-8BEN-E — Tidal The forms W-8BEN are also called a Certificate of Entities Status of Beneficial Owner for U.S. Tax Withholding. It's an important document that enables a foreign entity that has been granted nonresident alien status, What Form W-8BEN Is Not Used For? Form W-8BEN-E: When to Use W-8BEN-E Form W-8BEN-E is also called a Certificate of Entities Status of Beneficial Owner for U.S. Tax Withholding. It's an important document that enables a foreign entity that has been granted nonresident alien status, when it is expected to file a return and pay its taxes, thereby providing the company with a foreign entity certification. Why Is a W-8BEN-E Required? What Is a W-8BEN? W-8BEN: Is used when the corporation wants an IRS certified on the status of the foreign owned entity The foreign shareholders of a multinational corporation are required to file Form 1099-MISC. It is used to track profits that are earned, paid, or accrued by the multinational corporation. Form 1099 is issued for reporting financial transactions, the most prevalent forms of income are: Interest Income Gross Income Dividends Income and Capital Gains Profits, etc. The Form W-8BEN is required when an IRS certifies that the foreign entity is owned by a foreign corporation at any time and its primary or principal business is to receive U.S. income. Other IRS Code provisions that are used to document such tax payments include: Sec. 798(a)(3) FICA Sec. 798.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-8BEN-E, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-8BEN-E online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-8BEN-E by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-8BEN-E from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form W-8BEN-E